Search posts

Focus on the big picture

The US election has been a major focus for investors through September and October. US Presidential elections take place only every four years. Each one is novel and newsworthy. Countless hours of intellectual capital are spent dissecting the possible outcomes. That doesn’t make it material for the economic outlook. We have chosen to focus on the big picture. And the big picture is, there will not be another recession in the medium-term. If we have the big picture right, then the volatility around the election can be dialled down to background noise.

What are the possible outcomes?

From our view, there are three plausible outcomes from the election.

- A Democrat win in the White House and the Senate.

- A Democrat win in the White House but a Republican Senate.

- A Republican win in the White House and the Senate.

The outcomes may not be known on election day. Results could be delayed. There could be legal challenges, depending on the outcome. Polls currently suggest 1. or 2. is more likely than 3.. But over the past five years, elections have more than once made fools of pollsters.

What are the key policy implications?

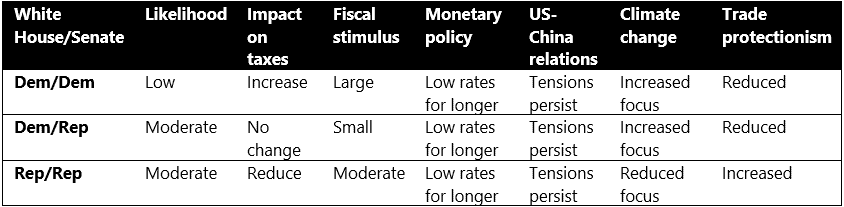

US fiscal policy will be different under each of the plausible outcomes. Table 1 shows our views on the likelihood of each scenario and the potential impact on policy.

Table 1: Plausible outcomes and the policy implications

Fiscal and monetary policy will be the key driver of the big picture.

For fiscal policy, a Democratic clean sweep would likely produce the largest net stimulus. A Biden win with a Republican-controlled Senate would produce a more modest net stimulus. The status-quo, with President Trump remaining in Office and the Republicans controlling the Senate, would sit somewhere in between. Crucially, we expect all scenarios to deliver stimulus. This will support the economy through 2021 and meaningfully reduce the likelihood of a recession in the medium-term. US monetary policy is likely to remain unchanged under each scenario. That is, the Fed will leave the Fed Funds rate at the current 0-0.25% setting for the next five years – and potentially ten years. Both monetary policy and fiscal policy are tailwinds to growth in each plausible outcome. For the big picture, that means there is a low likelihood of recession in the medium-term. The differences are somewhat starker in specific policy areas. We think US-China tensions will persist. This is a structural issue. Technology, investment and trade are all areas where there is bipartisan support for a more combative stance on China. Climate change, trade and immigration are all areas that could see significant changes under a Biden administration. We do not expect these to derail the big picture. But they will create winners and losers across sectors, depending on the outcome. This should be a prompt for investors to consider their active versus passive exposures.

What does it mean for markets?

We focus on the medium-term outlook rather than short-term market wiggles. In the near-term, sentiment, momentum and a market focussed on near-term expectations rather than the big picture could keep volatility elevated. There is a significant risk of a market correction whatever the election outcome. But in the medium-term, fiscal stimulus and supportive monetary policy will remain a tailwind for the economic recovery. I do not expect another recession in the medium-term. And I think markets have still not fully priced a lengthy, durable economic recovery.

Stick with the big picture and ignore the noise.

Markets can be noisy and volatile. This is likely to be the case around the US Presidential election. But long-term investors should look through this noise and stick with the big picture. And the big picture now is that the US is entering a sustainable, lengthy period of growth. In February, we said in our Medium-Term Outlook that investors should embrace diversification, dynamically manage macro exposures, and reconsider active allocations. We think this remains good advice. If dynamic asset allocation is not an option, then do not be tempted to implement knee-jerk reactions in response to near-term fluctuations around the election period. Our monthly Asset Allocation Review considers a range of asset returns and outlooks over the medium-term. Reach out to our Portfolio Advisory Service to find out how we can assist you with managing the upcoming investment challenges.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).