Search posts

Lump Sum Investing vs Dollar Cost Averaging

It has been a difficult period in financial markets, and it seems we are likely not out of the woods yet. However, during challenging times it pays to remember some important fundamentals of investing, in this article, we look at dollar cost averaging vs lump sum investing.

What is dollar-cost averaging?

Put simply, dollar-cost averaging (DCA) is the strategy of making incremental investments over time rather than investing a lump sum all at once.

The idea of DCA is that it helps investors “diversify” the cost of entry into the market, buying shares at prices that fall somewhere between the highs and lows of a fluctuating market.

Let’s break down the pros and cons of the two approaches when it comes to generating long-term wealth.

Investing a Lump Sum

Let’s consider investing $12,000 in cash earmarked for investment in equities. Instead of buying $12,000 in equities today, going the DCA route buys $1,000 worth of equities each month for the next 12 months. If the market increases in value each month during this period, you will pay a higher price on average than if investing all upfront. The opposite will be true if the market decreases steadily over the next 12 months.

While the focus may be on prices paid for these instalments, it’s important to remember that, unlike the lump-sum approach, a meaningful portion of your capital remains in cash rather than gaining exposure to the market. In this example, on average, half of the investable cash is forfeiting the higher expected returns of the stock market. This may be a big opportunity cost for investors with the goal of accumulating wealth.

Despite the potential drawbacks of dollar-cost averaging, some may be hesitant to plunk down all their investable money at once. Therefore, it may become an emotional decision instead of a financial decision. Trying to time the markets is difficult for even professional investors, so using a DCA approach to invest over time can feel safer.

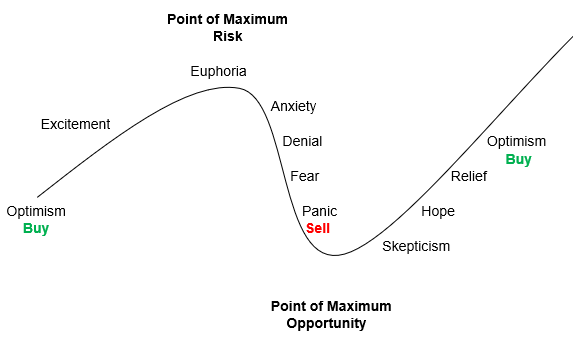

If you are investing over the longer-term time in the market versus, trying to time the market with a lump sum investment is difficult at best. If you are trying to time the market, you are likely to go on a rollercoaster of emotions, as you can see below, and potentially miss the point of maximum opportunity.

Both theory and data suggest that lump-sum investing is the more efficient approach to building wealth over time. But dollar-cost averaging may be a reasonable strategy for investors who might otherwise decide to stay out of the market altogether due to fears of a large downturn after investing a lump sum.

A Disciplined Approach to Savings

From a different perspective, dollar cost averaging can assist with smoothing the returns of investing regular savings. Assume you are starting to save some regular income, rather than waiting to accumulate a lump sum of cash and time the market, why not invest the surplus savings on a regular basis? This may offer a potentially higher average return than risking sitting on the sidelines and offer a more comfortable experience while avoiding what can sometimes be a rollercoaster of emotions watching the stock market.

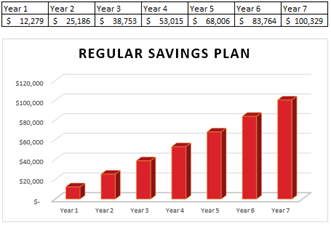

Let’s take another hypothetical example of investing a regular amount of $1,000 per month into a regular savings account. Assuming an average net return of 5% p.a. over 7 years, the effect of compounding returns of investing in the market over the long term could offer a disciplined approach to saving as well as the added benefit of market returns to your savings.

This is an example and should not be relied on as advice. Returns are never guaranteed.

In Summary

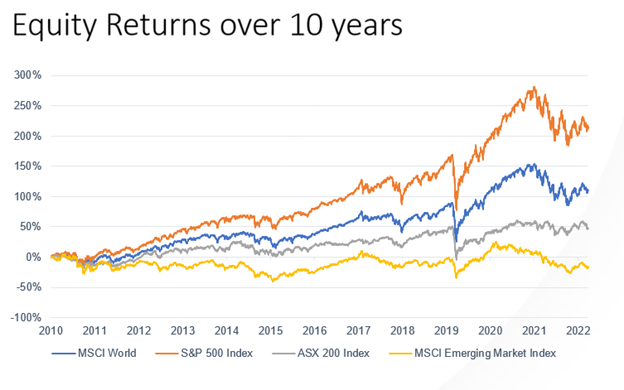

Historically, the stock market has offered a high average return and can be an important ally in helping investors reach their goals. Investing capital into equities, whether gradually or all at once, puts the holder in a position to reap the potential benefits. A trusted financial advisor can help investors decide which approach—lump-sum investing or dollar-cost averaging—is better for them.

What’s clear is that markets have rewarded investors over time. Whichever method one pursues, the goal is the same: developing a plan and sticking with it.

Past performance is not a guarantee of future results.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).