Search posts

Age-by-age guide to teaching kids about money

In this article Will Rainey, founder of Blue Tree Savings, goes through the different money topics he feels parents should be teaching their kids at different, indicative only, ages. These topics don’t just cover the basics of money, i.e. save to spend later, they focus on training your kids to become wealthy by following the ‘Three Rules of Wealth’. Most people don’t think about building wealth until much later in life and miss out on decades of compound interest working in their favour. Also, by teaching kids about becoming wealthy, from a young age, they are more likely to look after their money, i.e. spend less on things they don’t really need, especially on things to ‘keep up with the Jones’.

Aged 4 and below

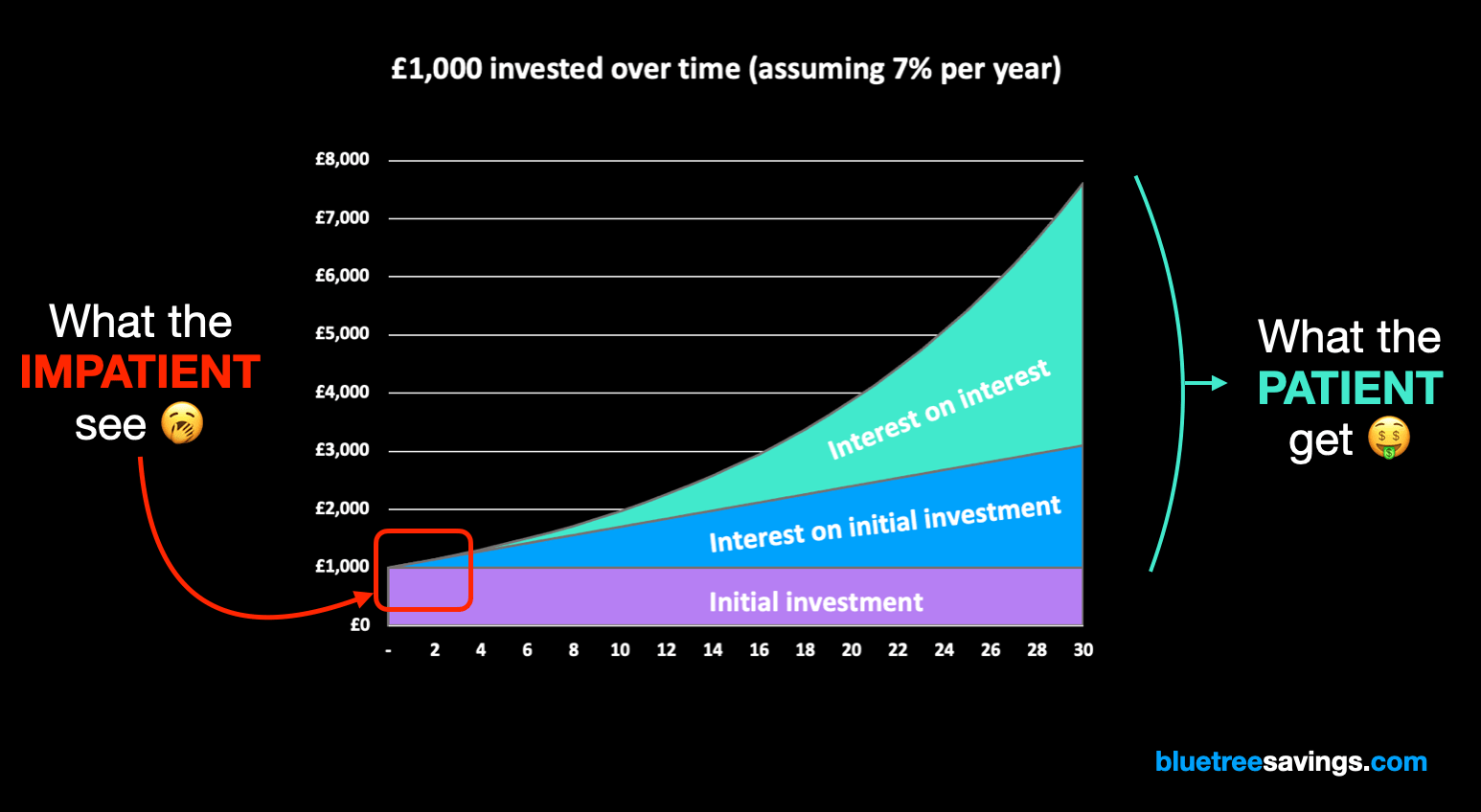

Being good with money is more about behaviours (temperament) than knowledge. So training your toddlers to have the behaviours which are aligned to being great with money is not a bad idea. Patience – This is the super power of those who are good with money. You can train your kids from a very early age to be patient. The key is to keep it small and reward them when they are patient. This could be getting them to save the last piece of chocolate for the next day and giving them something extra as a reward (the next day).

The reason to make sure your kids learn to be patient

The reason to make sure your kids learn to be patient

Budgeting – I’m not talking about budgeting their money here. I’m talking about budgeting how much TV they have or how many treat snacks they get. Maybe give them TV tokens at the start of the week and get them to decide when to use them. For example, they could decide to watch a small bit of TV each day or to watch more one day and none the next. They will soon work out not to use all their tokens too early. [This is from Robert Gardner, Author of the kids’ book ‘Save Your Acorns’]. It is important for parents not to give bonus tokens if your kid does spend all their tokens too early. This might be hard but it will pay dividends over the long-term. Play Shop – Kids love playing shop so you should encourage them. It helps them to understand money. Where possible, highlight how good it is to be the shopkeeper (who gets the money) rather than the shopper (who is giving their money away).

Aged 4-7 (SUPER IMPORTANT AGE!!)

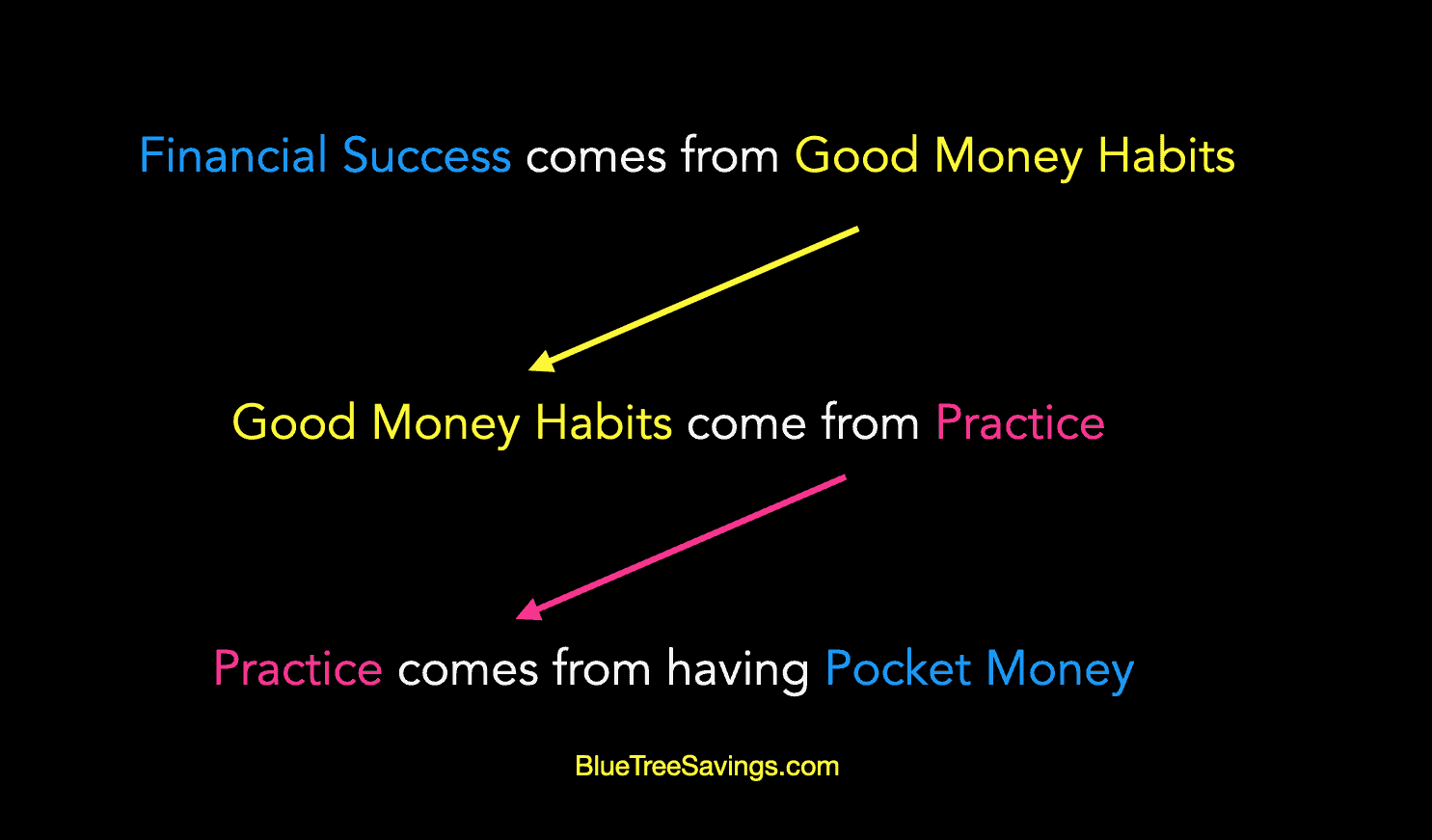

Research shows that we form many of our adult money habits by age 7. Therefore, this age is really important as we are helping our kids form brand new habits. After age 7, we have to re-program habits they have picked up which is harder. This is the age to introduce POCKET MONEY, even if it is just a small about.

Pocket money is the most underrated financial education tool there is.

Pocket money is the most underrated financial education tool there is.

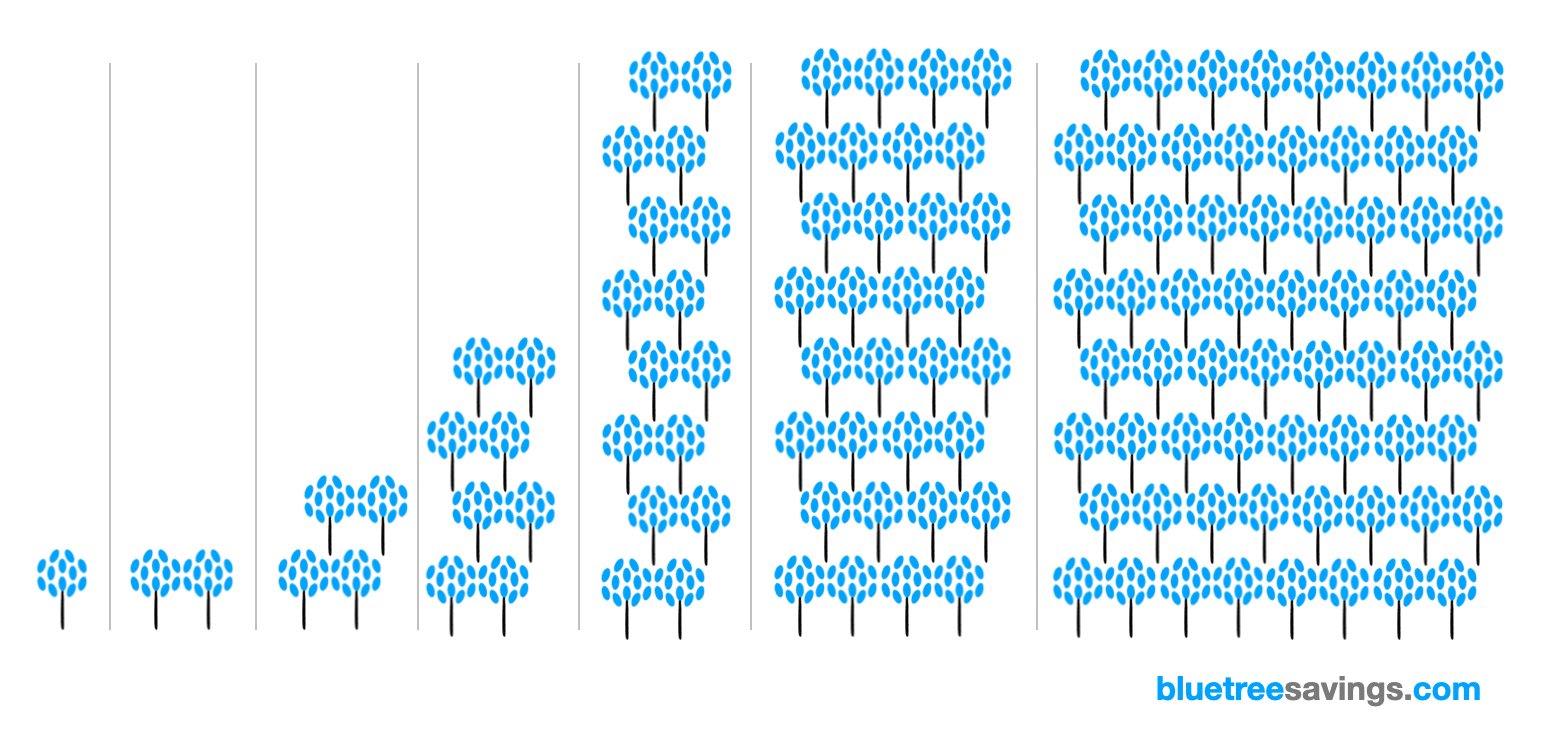

Money like seeds – Introduce the concept of money being like seeds. They can give those seeds away (spend) or plant them (save / invest). This teaches them that money isn’t just for spending. Their job is to make sure they plant some of their seeds (money) so they grow a forest over time. If they start planting a forest now, they will be well ahead when they are adults, especially as most adults don’t have any trees (savings).

Whilst money doesn’t grow on trees, it can grow like trees

Whilst money doesn’t grow on trees, it can grow like trees

Save before they spend habit – This is one of the most important habits for them to develop. Encourage your kids to save at least 10% of their money for the long-term (growing their forest) before they go out spending. They need to be doing this every time they receive some money (pocket money, tooth fairy, birthdays etc) so it becomes a habit. When they grow up and earn more, they will save more. This habit is the best defence against the billions that is spent by companies trying to get us to spend our money. Saving up for toys – Instead of buying them toys during the year (apart from on their Birthday, Christmas/special holidays celebrated by your family), give them pocket money and say this is for them to buy their own toys over the year. This helps them learn to budget, consider what they really want, understand the value of things, make spending mistakes (my daughter spent weeks saving up for a dragon toy and then hardly played with it as it wasn’t as good as she thought!). I note that this should be separate from saving 10% for the long-term (growing their forest).

Aged 8 – 12

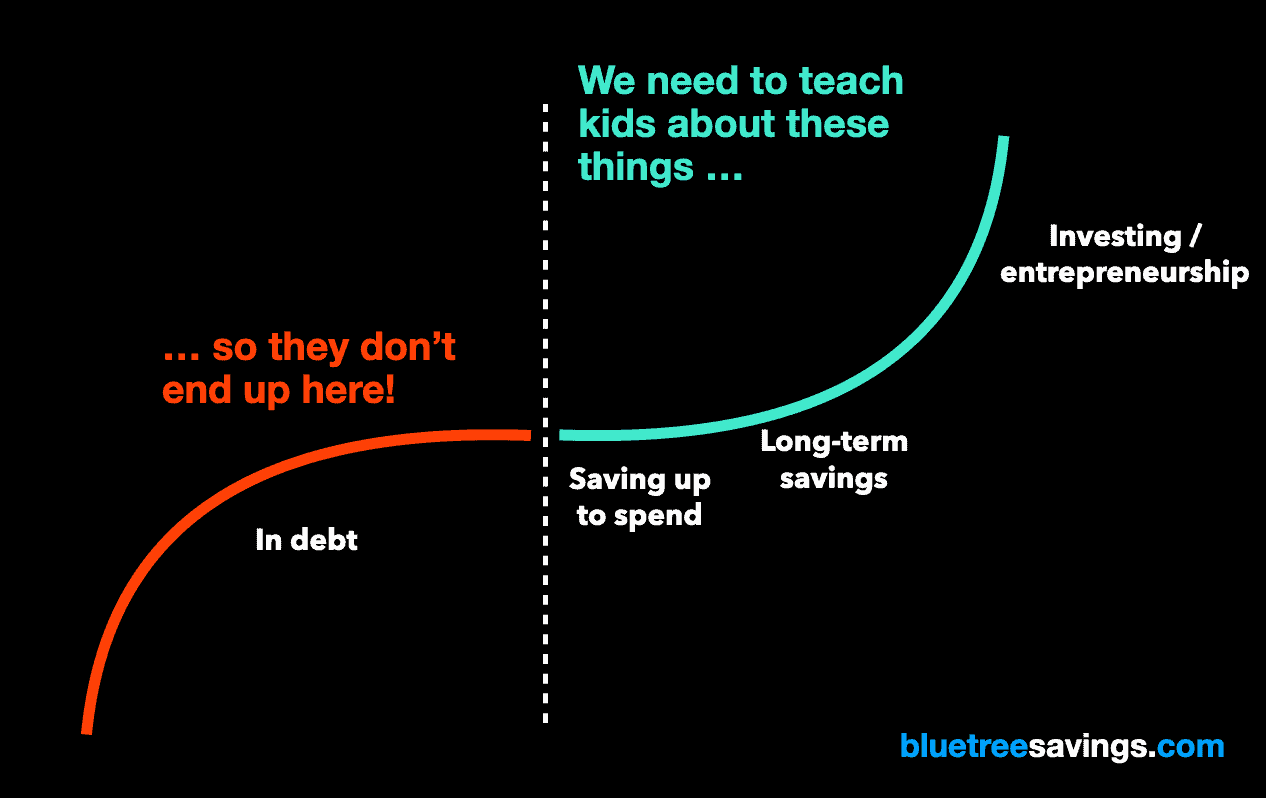

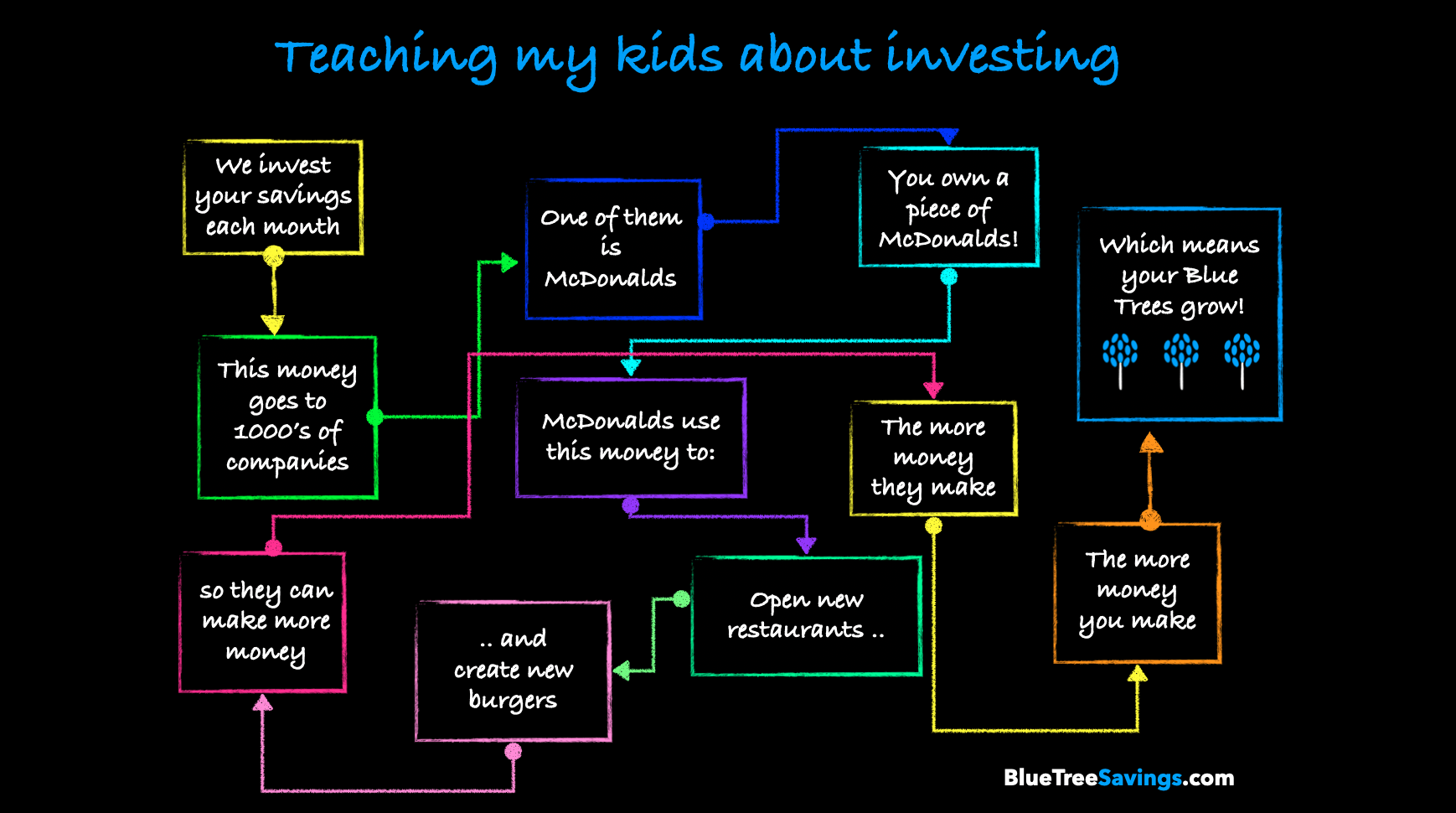

Continue to encourage your kids to follow the points raised above, especially in terms of being patient and forming the habit of saving before they spend. Money can grow (Investing) – Teach your kids that money can grow. You can talk about putting money in a bank account but the real value is teaching them about investing. This is how the wealthy grow their money.  Earning money – Teach your kids that by working hard they can earn money. You can create an extra jobs list for them to earn extra money (gardening, washing the car etc) – remember, this shouldn’t be for general daily chores (making their beds, dishes etc). Rather than just making the link between working hard and money, try to introduce the concept of starting a business and working smart (e.g. a lemonade stand). You never know, your kids might have a hidden entrepreneurial talent. Charity – Teaching kids that they can use money to help others can lead them to avoid focusing simply on what they have and what their friends (and people on social media) have.

Earning money – Teach your kids that by working hard they can earn money. You can create an extra jobs list for them to earn extra money (gardening, washing the car etc) – remember, this shouldn’t be for general daily chores (making their beds, dishes etc). Rather than just making the link between working hard and money, try to introduce the concept of starting a business and working smart (e.g. a lemonade stand). You never know, your kids might have a hidden entrepreneurial talent. Charity – Teaching kids that they can use money to help others can lead them to avoid focusing simply on what they have and what their friends (and people on social media) have.

Aged 13+

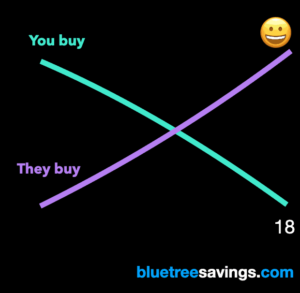

Hopefully by this age your kids have started to form a good savings habit and thought about different ways to earn money. Now is the time for them to be aware of different money topics and taking on more financial responsibility. Teach them about debt, tax, gambling and scams – These are really important topics which can really impact their lives and we need our kids to be aware of these topics before they first experience them as adults. They won’t learn these in school (sadly) – therefore we as parents need to help them. Give them a bank account – Giving your kids their own bank account and debit card is a great way for them to appreciate how to manage money themselves. This is a prime time to let them make money mistakes and, with your help, learn from these mistakes. Whilst we want to encourage them to do the right thing, we should ultimately let them decide. If they waste their money, so be it, this experience will stay with them and potentially avoid them making similar mistakes when they become adults which could instead cost them thousands. Greater spending responsibilities – By the time they are 18, they will be responsible (I hope) for all their discretionary spending decisions. So, this stage of life is making sure you gradually transfer more spending responsibilities to them. Whilst you might still give them pocket money, this pocket money should now cover an increasing list of expenditures. For example, at 13 you might say their pocket money now covers going to the cinema (or equivalent) with their friends twice a month. Then it might increase to cover casual clothes and electronics.  Wealthy Kids, not Rich Kids – With so much more freedom to make decisions, social pressure and ease at which they can spend money, it’s super important to remind our kids that they need to save some of their money so it can grow. It’s those that grow their money that go on to have financially healthy lives. Teach them that there are plenty of examples of people having lots of money (pop stars, sports stars, lottery winners) but who ended up in financial hardship as they simply spent all their money. Essentially, we need to make sure kids grow up wanting to be ‘Wealthy’ (having money which makes them more money), not ‘Rich’ (using money just for spending).

Wealthy Kids, not Rich Kids – With so much more freedom to make decisions, social pressure and ease at which they can spend money, it’s super important to remind our kids that they need to save some of their money so it can grow. It’s those that grow their money that go on to have financially healthy lives. Teach them that there are plenty of examples of people having lots of money (pop stars, sports stars, lottery winners) but who ended up in financial hardship as they simply spent all their money. Essentially, we need to make sure kids grow up wanting to be ‘Wealthy’ (having money which makes them more money), not ‘Rich’ (using money just for spending).

Summary

Don’t leave your kids’ financial future to chance – start teaching them about money today! If you follow these actions at these ages, I’m super confident your kids will grow up financially healthy. You’ll be training them to earn money and follow the Three Rules of Wealth:

- Spend less than you earn

- Invest what you save

- Be patient

Remember, it’s never too early and never too late to teach your kids about money. Article provided by Will Rainey, Founder, Blue Tree Savings Contact us to learn more about how we can help your kids.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).