Search posts

Tweets, Tariffs and Timing

Predicting turning points in asset prices is hard. Forecasting spikes in market volatility is difficult. The persistence of market trends is variable. Reversals can happen suddenly and violently. The round trip in global equity markets during Q4 2018 and Q1 2019 are clear examples of this. The 5.8% one-day decline in Chinese equities following a Presidential Tweet is another. Asset price movements provide an opportunity for the market to impose a harsh discipline on investors. The punishment may be higher portfolio volatility, lower portfolio returns, or both. It is too late to prepare a portfolio for adverse volatility after it has happened. The Oreana 2019 Global Medium-Term Outlook suggested discipline, dynamism and diversification could help prepare portfolios for market volatility.

Tweets and Tariffs

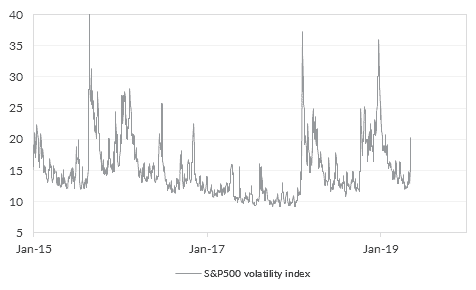

Global equity market volatility increased after a Presidential Tweet indicated US tariffs on imports from China could increase from 10% to 25% (Figure 1). Equity prices had rallied hard in 2019 through to early May. At least some of that rally reflected market pricing for a positive outcome in US-Chinese trade negotiations.

Figure 1: Volatility spiked suddenly in May following Presidential Tweets

The impact of tariff increases is uncertain, difficult to calculate, and likely non-linear. A 25% tariff may be more than 2.5 times worse than a 10% tariff. At time of writing, we don’t know if further tariffs will be implemented. But we didn’t need to know that to have moved from highly overweight Chinese equities to highly underweight in late March.

The impact of tariff increases is uncertain, difficult to calculate, and likely non-linear. A 25% tariff may be more than 2.5 times worse than a 10% tariff. At time of writing, we don’t know if further tariffs will be implemented. But we didn’t need to know that to have moved from highly overweight Chinese equities to highly underweight in late March.

Investor discipline is better than market discipline

We use a clear repeatable process that forces discipline on the Investment Team.

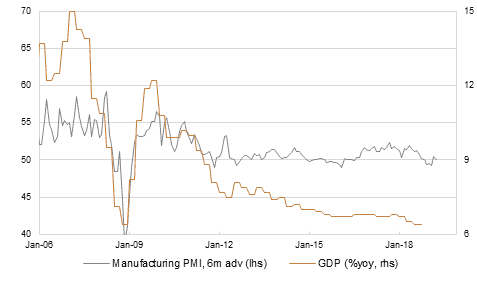

- A clear, risk-weighted fundamental view: Our fundamental view of the world is that Chinese economic growth is structurally slowing (Figure 2). The monetary and fiscal stimulus implemented in late 2018 would be unlikely to substantially shift growth higher in the medium-term. We are unsure about tariffs. But risks to growth remained skewed to the downside rather than the upside.

Figure 2: China’s growth is slowing structurally, and risks are to the downside

- A clear, quantifiable fair valuation: We believe that the intrinsic value of assets reflects the discounted cash flows available to those assets. The intrinsic value of the assets we invest in can be quantified using models that directly reflect our fundamental economic view. In early-March, Chinese equities had moved above and beyond our estimate of intrinsic value.

- Clear risk-adjusted return targets over the medium-term: Our process uses expected risk-adjusted returns across a five-year outlook to build time-variant price targets levels for assets. When asset prices reach certain levels, it is a clear trigger to move portfolio positioning over or underweight. By late March, Chinese equities had already reached high prices relative to our view of intrinsic value. This was the trigger to move highly underweight Chinese equities.

We think now is still the time to implement and adopt a clear, disciplined and repeatable process for managing risk adjusted returns within the portfolio.

Dynamism is not timing the market

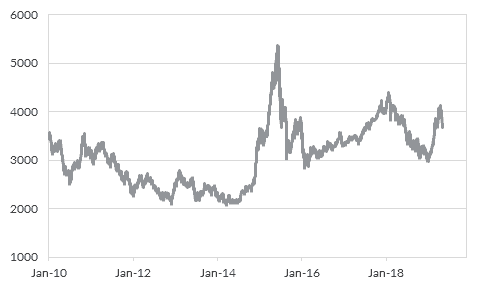

We don’t know if the recent price moves in Chinese equities (Figure 3) reflect:

- An inflection point with the possibility of a correction,

- A short pause in a rally that could reassert itself and push the market to new recent highs, or

- A longer pause in a rally that could result in Chinese equities broadly trading sideways for some time.

Figure 3: Chinese equities have declined 10.3% from their peak in mid-April

All three are plausible. Our goal is not to be short-term market timers. Our dynamic process tells us that there are better risk-adjusted returns on offer over the next five years. We think now is still the time to dynamically allocate to those opportunities rather than guessing the direction of markets in the near-term.

All three are plausible. Our goal is not to be short-term market timers. Our dynamic process tells us that there are better risk-adjusted returns on offer over the next five years. We think now is still the time to dynamically allocate to those opportunities rather than guessing the direction of markets in the near-term.

Diversification is easy to talk about. It is hard to achieve.

Does an investment in a tech focused equity fund diversify from equity beta? Does an investment in select private debt opportunities diversify from credit beta? We think the latter does provide an important element of diversification within a portfolio. We are skeptical about the former. The latter is a market that has grown due to regulatory change and offers different return drivers for those able to identify and access it. The former is (typically) a collection of high growth stocks within a single sector that has a high correlation to the broader equity market. There are opportunities for outsized returns during up markets, and outsized drawdowns during down markets. We think now is still the time to review exposure to alternatives and to look to diversify drivers of return within the portfolio.

Conclusion

Repeatedly predicting market movements is difficult. Getting timing consistently right in a multi-asset portfolio is harder. Market volatility can be sudden. It can be driven by changing fundamentals, by sentiment, or even by a Tweet. Our process does not try to time the markets. Instead we aim to improve risk-adjusted performance through the cycle. We identified several key recommendations in the Oreana 2019 Global Medium-Term Outlook. Three of these are particularly relevant given recent price action.

- Now is still the time to use a clear, disciplined and repeatable process to manage risk within the portfolio,

- Now is still the time to dynamically allocate to those better risk-adjusted opportunities rather than guessing the direction of markets in the near-term, and

- Now is still the time to review exposure to alternatives and to look to diversify drivers of risk-adjusted returns within the portfolio.

Contact Oreana Financial Services or your affiliated Advisor to find out how we can assist with managing your wealth.

Data sources: Bloomberg LP, Oreana Financial Services

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).