Search posts

The opportunity in Hong Kong

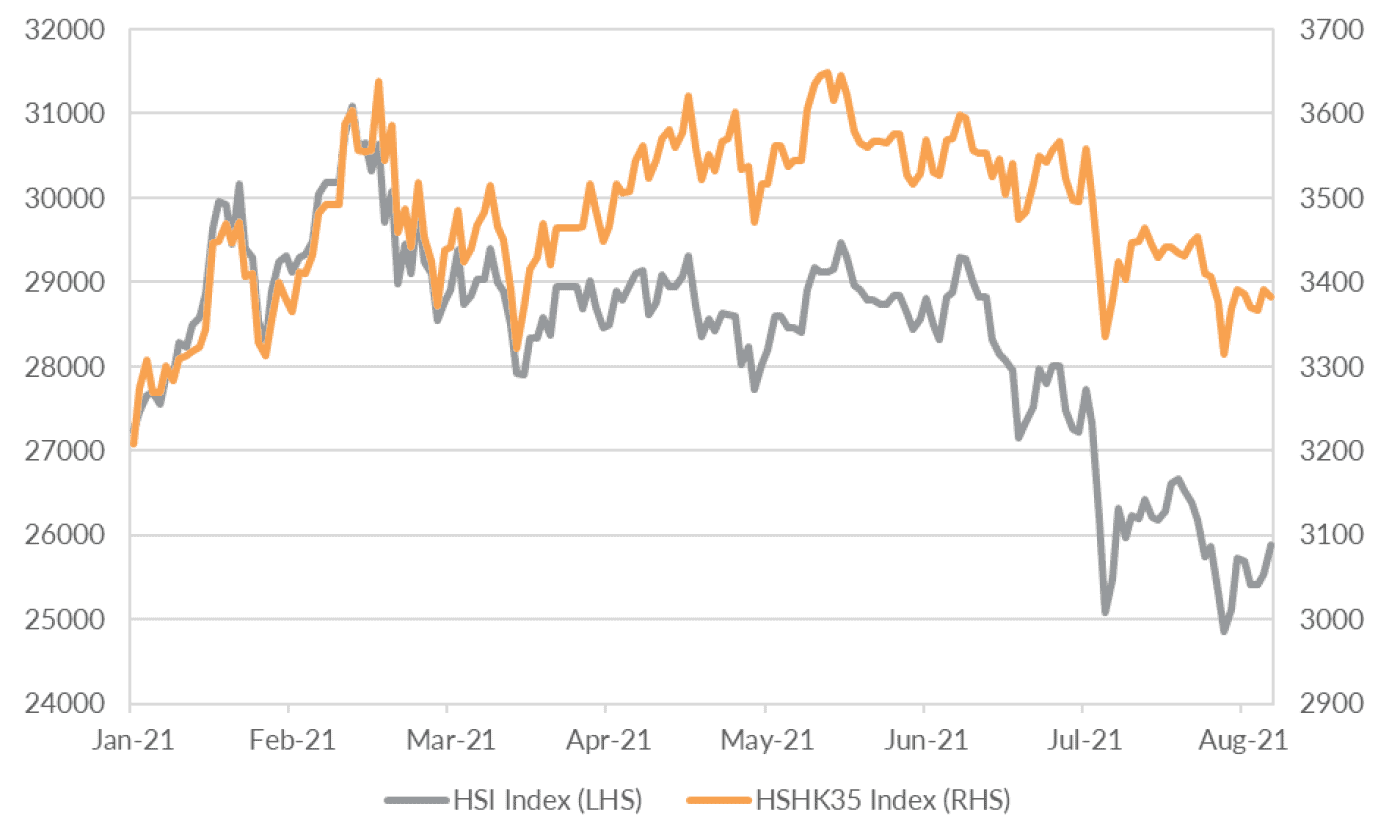

The recent equity market selloff amid Chinese regulatory changes and concern over slowing GDP growth has created opportunities in Hong Kong equities. The Hang Seng Index has slipped over 5% year-to-date. But domestic Hong Kong stocks did not suffer to the same extent as listed mainland Chinese companies. The Hang Seng HK 35 Index, which comprises the 35 largest companies listed in Hong Kong that largely generate sales revenue from areas outside mainland China, currently is 5.4% higher year-to-date (Figure 1).

Figure 1: The Hang Seng HK 35 Index is higher year-to-date

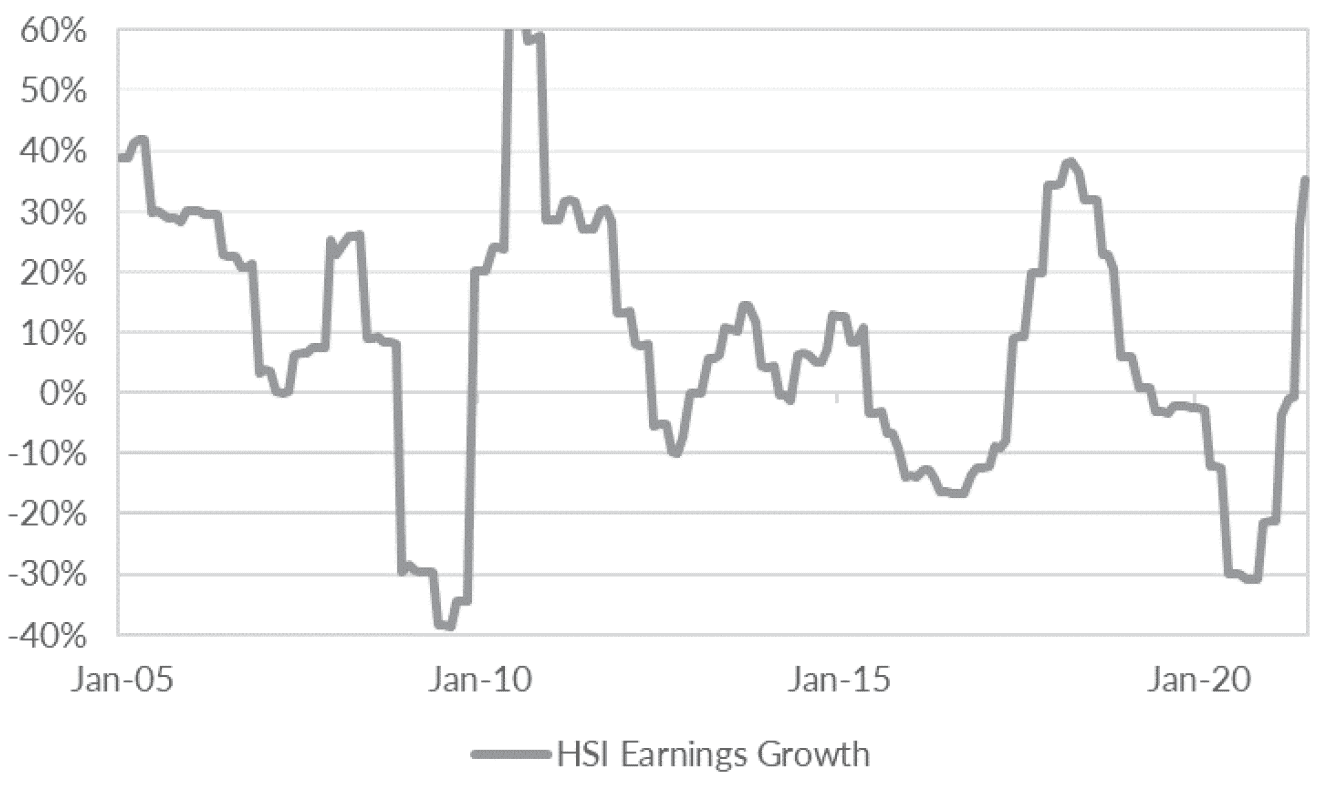

We think the Hong Kong equity market is now up to 40% undervalued. That provides potential for strong returns over the next few years. Earnings growth is making a V-shaped recovery (Figure 2). We expect 2022-2023 earnings to rise more than the market has priced in. Sales growth is at its highest since 2018. The post-Covid economic recovery, and increasing integration with China, offers an opportune environment for growth.

The domestic and global economic recoveries are underway

The global economic recovery will help drive returns in Hong Kong. The economic recovery is already underway as Hong Kong’s zero-covid strategy has allowed for the resumption of domestic economy activity. Real GDP grew by 7.6% in Q2 compared with a year earlier as the domestic economy recovered and exports were supported by the release of pent-up global demand.

But there is still a huge amount of scope for growth, especially in the tourism and retail industries. This will be propped up by the global economic recovery and the resumption of inbound travel from mainland China and other countries in 2022. Many companies in Hong Kong are likely to see strong sales and earnings growth in the coming years.

Figure 2: Earnings growth has made a V-shaped recovery

The Greater Bay Area provides a huge opportunity to Hong Kong companies

Hong Kong companies will also have more opportunities to expand into the GBA. The GBA is a key national economic development strategy in China’s 14th Five-Year Plan. Technology and innovation as well as financial integration are at the core of the strategy to develop an international bay area with global influence.

The hub will be focused on investment in R&D and technological innovation. But with a population of nearly 100 million and a GDP of USD 1.5 trillion, the GBA provides a huge consumer-base for companies based in Hong Kong to leverage. Companies in many consumer goods, retail and food and beverage industries could scale their businesses and grow rapidly as Hong Kong becomes increasingly integrated in the GBA.

Financial integration will encourage cross-border investment across the GBA

In order to become a world financial centre, the GBA aims to leverage the advantages of Hong Kong’s financial system. The introduction of Shenzhen and Shanghai Stock Connect schemes, and Bond Connect, have increasingly allowed cross border investment. This has increased the liberalisation of China’s financial system, and increasingly integrated Hong Kong and China’s stock and bond markets.

But international inflows have been relatively restricted and almost exclusively utilized by institutional investors. Wealth Management Connect is the next step to allow further crossborder access to securities markets. This scheme will allow GBA residents to purchase financial products in any other city in the GBA, including Hong Kong. An increasingly large pool of affluent Mainland Chinese retail investors seeking to diversify their investment portfolios will have access to financial securities in Hong Kong.

We think geopolitical tensions have been somewhat priced in

Domestic and international political tensions remain a risk. We think they are structural risks. Although post-Covid may reopen some wounds from political tensions, Hong Kong’s political environment is now at least partly priced into the market.

Meanwhile, President Biden has continued the previous administration’s firm stance on China. US-China tensions are here to stay for the foreseeable future. Risks remain. Knee-jerk reactions and policy error are a danger. But the current administration appears to have shifted that danger from acute to structural.

Further restrictions on Chinese IPOs and threats of delisting Chinese companies in the US is driving secondary IPOs to Hong Kong, and encouraging Chinese companies to delist in the US and relist in Hong Kong.

ESG in Hong Kong will improve outcomes over the medium-term

We believe sustainable investing is a source of medium-term alpha. Surveys indicate that investment professionals who consider ESG factors in their portfolio construction processes do so to seek better risk-adjusted returns.

Hong Kong is being proactive rather than reactive to the growing trend of ESG. Regulators in Hong Kong have recently enhanced disclosure requirements and assessment criteria for ESG or climate-focused funds. Further to this, the SFC has released a concrete set of requirements for all funds to incorporate environmental risk management practices in their investment processes, and improve disclosures.

An opportunity for the first time since 2019

In 2019, we shifted Hong Kong equities to Highly Unattractive, our lowest investment rating. We explained they were at least 20% overvalued. We now see strong opportunities in the stock market. For investors based in Hong Kong, that suggests some allocation to Hong Kong and China in the equity sleeve of the portfolio. For investors outside of Hong Kong, the opportunity could be access through an allocation to broader Asian equities.

Contact PAS for more information

The Portfolio Advisory Service has been working with clients across Australia and Asia to help manage investment solutions. Our work is supported by deep asset class research and manager review expertise within the team.

Reach out to our Portfolio Advisory Service to find out how we can assist you with managing your investment challenges.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).