Search posts

Russia and Ukraine: an update amidst uncertainty

The Russia and Ukraine conflict is a source of significant uncertainty for markets. The Russian presence along the border gave way to recognition by Russia of two separatist regions. That in turn gave way to a full-scale invasion on Ukraine by Russia beginning 24 February. The West has responded with sweeping sanctions, and financial and physical support for Ukraine via provisions and weaponry. The outcome remains exceptionally uncertain.

In this Insights, we answer some questions and provide some guidance through this challenging episode.

What are the potential scenarios?

We believe in recognising the limits of our expertise. We don’t profess to have additional insights into the military action, geopolitical response, or humanitarian crisis. So, we do not aim to build a “most-likely outcome”. Instead, we recognise our lack of expertise and accept that the range of potential outcomes is extraordinarily wide. They range from extremely bad outcomes (e.g a global hot conflict) to much better outcomes (e.g resumption of diplomatic efforts).

Plausible scenarios in the range include:

- Concessions to Russia to allow them an off-ramp and end to hot conflict.

- Full scale invasion with no or limited NATO military involvement, but significant economic sanctions from the West.

- Full scale invasion with some NATO military involvement, and significant sanctions from the West.

- Full scale invasion with significant NATO military involvement, significant sanctions from the West, and weaponization by Russia of its oil, gas and soft commodity exports.

What are markets pricing in?

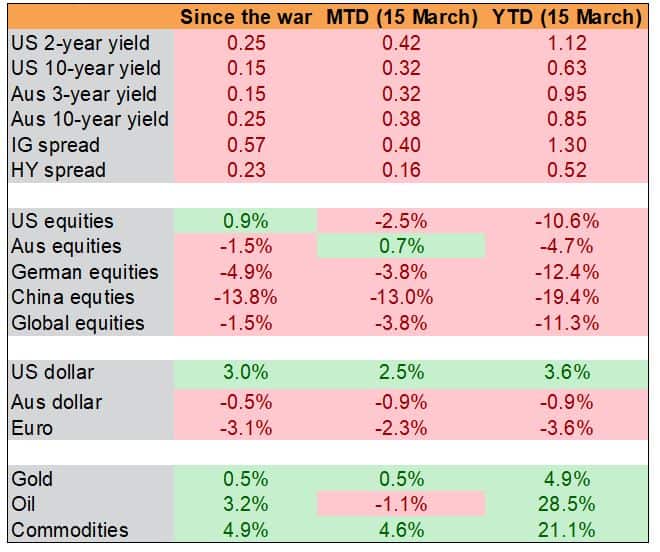

Global equity markets have declined more than 11% this year. Almost all of that occurred before the invasion began. US 10-year Treasury yields are 0.63% higher so far this year. Most of that shift higher reflects movements before the war started.

For sovereign bonds and equities, the dominant market movements reflect that prospect for global central bank tightening. That is connected to the war in Ukraine, indirectly. The war has pushed commodity, energy, and food prices sharply higher. Inflation expectations have increased as a result. That has in turn added to market pricing for aggressive rate hikes from the Fed and other central banks.

Table 1: Most of the equity market falls occurred before the war began.

Source: Bloomberg LP, Oreana Portfolio Advisory Service

Has the medium-term outlook changed?

We think not materially. The prevailing narrative remains solid economic growth. Downside risks have increased, however. The uncertainty around the pathway for the war has increased recession risk in Europe, for example, and in the US.

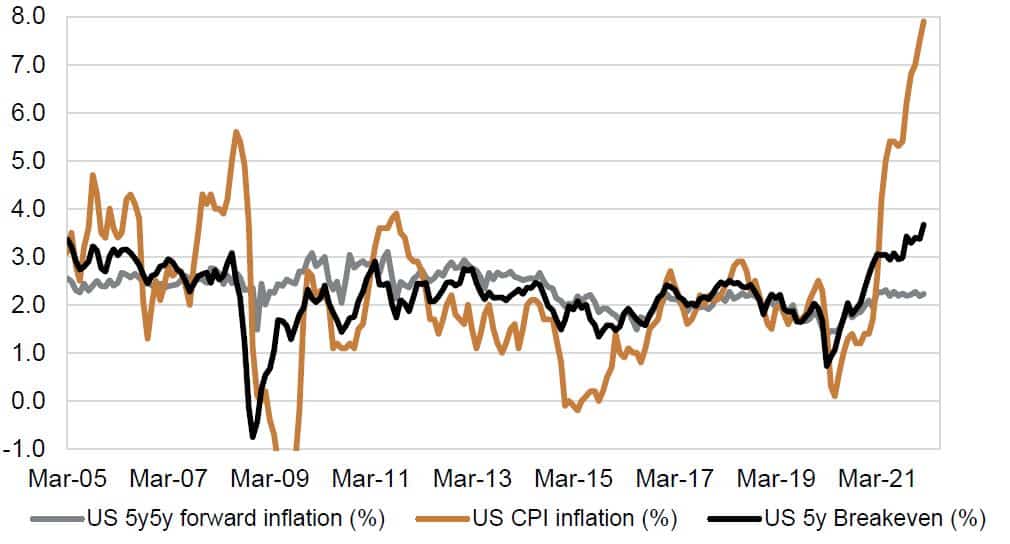

US inflation is significantly higher than the Fed’s 2.0% target (Chart 1). Breakeven inflation (i.e market pricing for future inflation) has also surged. We had expected that to begin to ease in H2 2022. That may be challenged now as supply chains and food and energy supplies from Ukraine and Russia are disrupted. The prospect for higher inflation could weigh on growth more than we expected.

Markets continue to price as many as seven rate hikes from the US Federal Reserve this year. The Fed has indicated it will engage in significant balance sheet reduction this year. We continue to think the Fed will be more cautious than the market has priced.

The Fed will want to avoid a recession. This means the Fed will want to avoid the yield curve – the difference between US 10-year Treasury yields and US 2-year Treasury yields – falling below zero. At the margin, the uncertainty caused by the war allows the Fed to be more circumspect about their pathway to rate normalisation. And we expect that will allow solid economic growth and solid earnings growth to support equity market returns at attractive levels.

Chart 1: Inflation has surged in the US. Inflation breakeven expectations have also moved to high levels.

Source: Bloomberg LP, Oreana Portfolio Advisory Service

What is the impact of higher energy and commodity prices?

The war in Ukraine has resulted in wild swings in the oil price. This has put significant upwards pressure on fuel and energy prices through the world. Higher energy and fuel prices act as a tax on household balance sheets, and reduce disposable income. This is particularly acute in the US, and lower income households in Australia.

The pressure can result in changes in preferences – reduced spending on consumer discretionary goods, reduced travel, for example. It is challenging for central banks to directly reduce these inflationary costs through rate hikes, however.

We expect some of these price pressures to persist. Higher commodity and oil prices can be a significant benefit to some companies and countries. Australia is an example of an equity index that has benefited. We continue to believe Australian equities are highly attractive – a view that we implemented in January this year. However, we caution that higher commodity and energy prices can become self-limiting. That is, they can become so high that it puts downwards pressure on growth. We don’t know exactly at which point we will reach that level, but we think we are not there yet.

What can investors do?

Periods of episodic extreme uncertainty are not times to make knee-jerk reactions. Markets can move non-linearly, in unexpected directions, aggressively and rapidly. Instead, now is the time to rely on your clear investment philosophy and investment process.

For predominately strategic asset allocation (SAA) investors, that means relying on diversification. Exposures to cash, sovereign debt, high quality fixed interest play an important role in SAA portfolios. That role came under serious challenge so far this year. Longer-dated bond yields surged and drove capital losses in portfolios. The importance of having some downside protection against uncertain outcomes is highlighted by the recent market movements. As is the critical importance of rebalancing portfolios after significant asset moves such as we saw through 2021.

For dynamic asset allocation (DAA) or active investors, the challenge is to push back against the temptation to make short-term portfolio changes. Instead, it is important to rely on process. For us, that means:

- Review scenarios that could materially change the medium-term outlook.

- Review the existing medium-term outlook against those scenarios.

- Consider whether the portfolio will need adjusting if those scenarios materialise.

- Adjust the portfolio, if necessary, when we get more clarity about the Russia Ukraine conflict outcome.

Importantly, we recommend being aware of sell-the-rumour, buy-the-fact events. Previous conflicts that have driven episodic widening of risk premia have been followed by rapid narrowing of risk premia after the uncertainty has declined. In other words, as the negative news flow grows, investors may price in ever-more negative outcomes. They may become overly pessimistic. Subsequently, even a relatively bad absolute outcome can be better than market expectations – and result in a perverse increase in equity prices.

Contact PAS for more information

The Portfolio Advisory Service has been working with clients across Australia and Asia to help manage investment solutions. This includes a clear move towards managed accounts within the Australian and Hong Kong markets, as well as a focus on investment governance and investment process. The Portfolio Advisory Service can help build custom-made investment solutions including managed accounts, or by providing access to our own range of Active Alpha, Active Beta Plus and Active Beta portfolios. Our work is supported by deep asset class research and manager review expertise within the team – delivering great outcomes for our partners.

Reach out to our Portfolio Advisory Service to find out how we can assist you with managing your investment challenges.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).