Search posts

Medium-term outlook redux

Our 2020 Medium-term Outlook, published in February, warned of a likely recession over 2020-21. We recommended focusing on resilient portfolios to reduce surprises. We made several key suggestions, including:

- Improve portfolio diversity,

- Review liquidity risks using scenario analysis,

- Increase exposure to high quality sovereign debt and reduce exposure to lower quality high yield debt, and

- Reduce risk now to increase risk later.

We expected these actions – while difficult to implement – would improve resilience through a challenging period including a significant equity market drawdown. The recession has come. Equity markets had a significant drawdown. Low quality debt suffered liquidity issues. Exposures to sovereign debt improved portfolio resilience. Portfolios with less risk suffered smaller drawdowns.

Fundamentals have changed

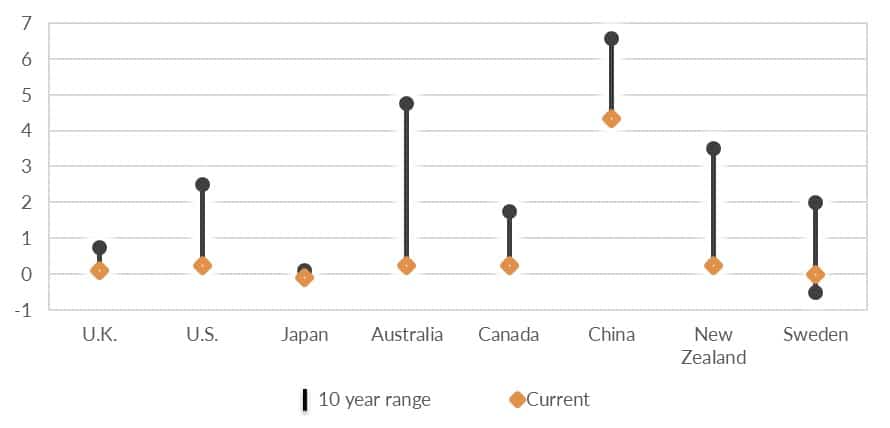

While we did not predict the cause, our forecast for recession has become reality. The Fed and other global central banks have cut rates and introduced aggressive quantitative easing, as we had anticipated (Chart 1). Fiscal policy has been more supportive than we expected. The recession looks likely to be two quarters in length, in line with our modelling. The recovery looks most likely to be in line with our “Recessionary” scenario, as opposed to our worse “Depression” or better “V-shaped recovery” scenarios.

Chart 1: Global central banks cut policy rates to historic low levels

As the outlook became clearer and risk premia widened in equity markets, our process led us to increase our exposures to equity. We reduced our exposure to sovereign debt. Our portfolios went from being low risk to a neutral risk setting. Markets have recovered and economic data are showing signs of improvement. The critical question for us is whether the fundamental outlook – embodied in our 2020 Medium-term Outlook – has changed. We think it has.

As the outlook became clearer and risk premia widened in equity markets, our process led us to increase our exposures to equity. We reduced our exposure to sovereign debt. Our portfolios went from being low risk to a neutral risk setting. Markets have recovered and economic data are showing signs of improvement. The critical question for us is whether the fundamental outlook – embodied in our 2020 Medium-term Outlook – has changed. We think it has.

No recession in the outlook

We do not expect another recession over the coming five years. Central banks, and the Fed in particular, have implemented incredibly accommodative monetary policy settings. Fiscal policy has been eased and will continue to support growth through 2021. Many of the fragilities that worried us, including excess leverage and declining credit quality, have been kicked down the road. Instead of recession, we expect a solid recovery in 2021. Not a “V-shape”. The level of activity will take some time to grind back up to where it was at the end of 2019. But growth rates will be high. Global job growth will remain positive as economies undergo a gradual reopening. And inflation is likely to remain contained as economic slack is only slowly reined in.

A positive outlook…

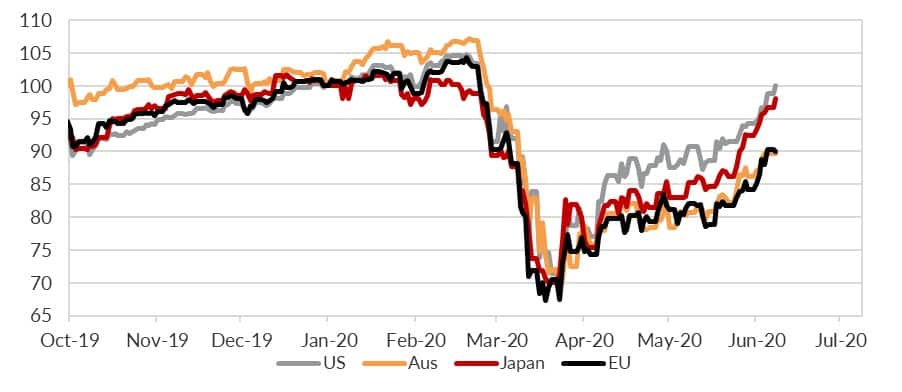

This is a significant fundamental change in our view. Some of it has been priced in by equity markets that have rebounded over Q2 2020 (Chart 2). But we think markets will move to price a rebound in growth and a reduced risk of recession over the coming five years.

Chart 2: Equity markets have rebounded over Q2 2020

Risks remain. Lower quality credit could suffer a surge in defaults. A sharp rise in inflation could lead a disruptive sell off in high-quality sovereign bonds. Equity markets may be in for a period of volatility as policy uncertainty increases. But we no longer think these risks dominate the medium-term outlook.

Risks remain. Lower quality credit could suffer a surge in defaults. A sharp rise in inflation could lead a disruptive sell off in high-quality sovereign bonds. Equity markets may be in for a period of volatility as policy uncertainty increases. But we no longer think these risks dominate the medium-term outlook.

… which is not consensus

We held an out-of-consensus view in late-2019. Expecting a recession, and positioning for it, was not a widely held expectation. We think now the consensus view is that risks are skewed to the downside. This rally has been distrusted and disliked by many in the market. We think we are now at the beginning of a multi-year economic recovery. There will be some bumps along the road. But our outlook includes new record prices being established in major developed market equities over the next five years.

A new outlook

We ended 2019 expecting a recession in 2020. It is happening now. We expect the recession to end in Q2 or Q3, before a recovery takes place. We think that will drive returns above historic averages over coming five years. The changes to our fundamental outlook have resulted in material improvements to our return expectations. Returns will vary across asset classes and within asset classes. Diversification, clarity around implementation, and a strong governance framework around the risk budget will be necessary to improve return outcomes. A dependable private wealth management service can prove invaluable in assisting you manage your asset. Reach out to our Portfolio Advisory Service to find out how we can assist with managing your investment challenges.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).