Search posts

Inflation is here to stay

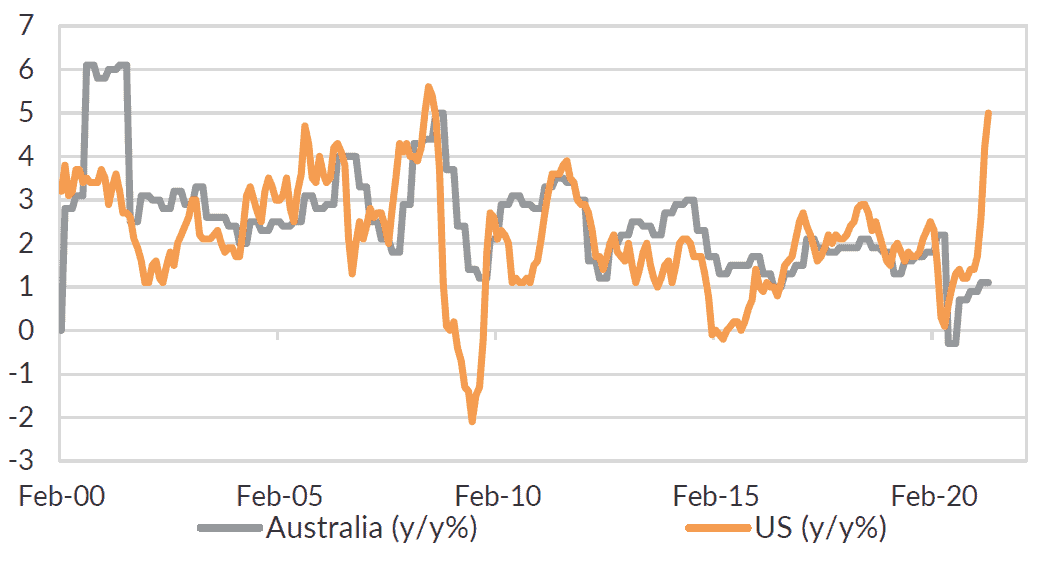

There are growing signs that inflation is rising. Headline inflation in the US and Australia is on the rise (Chart 1). Wage pressures are beginning to emerge. The price of a range of goods and services have increased compared with a year earlier. Partly that reflects very weak inflation during the height of the pandemic. But we think inflation pressures are likely to be more persistent than central banks expect over the medium-term. That will put upwards pressure on sovereign bond yields.

Chart 1: Inflation is moving higher in the US and Australia.

What matters for the Fed and the RBA?

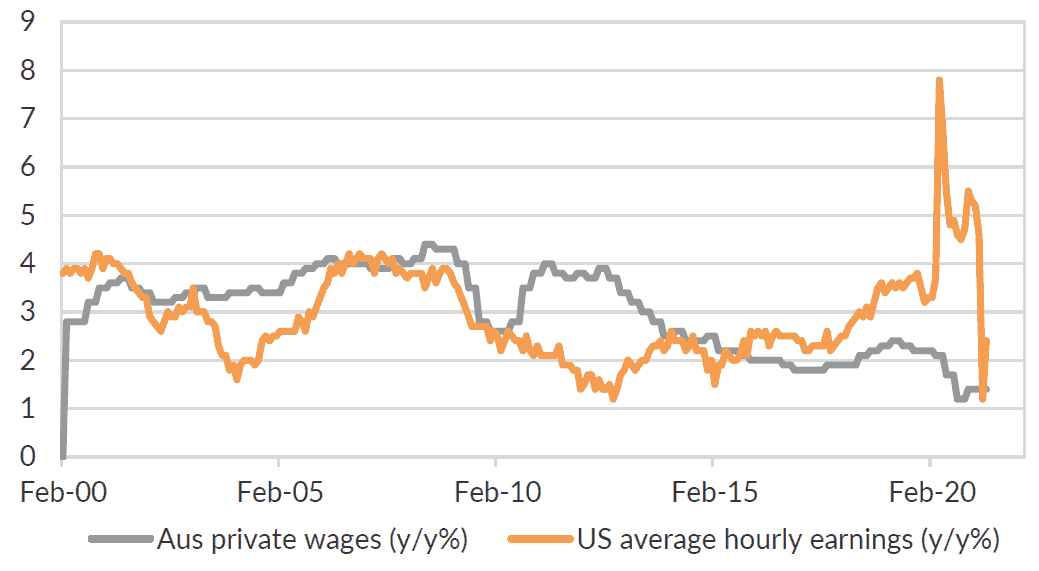

The US Federal Reserve and the Reserve Bank of Australia will focus on wage pressures. Wage pressures have been weak for some time in both economies (Chart 2). But there is anecdotal evidence of wage hikes in lower wage jobs. Labour supply has been tight, particularly in the US. This has been exacerbated by schools remaining closed – and so keeping some workers out of the labour force – and by generous fiscal packages that have reduced the incentive to work in some cases.

We expect wage pressures to remain subdued relative to longer-term history. But we think they will increase compared to the past five years. That will be a gradual, continued rise over the medium-term.

In the near-term, inflation will be significantly higher than central bank targets. That reflects the weak inflation during the pandemic and a recovery now. In the medium-term, we expect this excess inflation will ease back. But it should still leave inflation at or slightly above central bank inflation targets over the medium-term.

Chart 2: Wage pressures have been low for more than five years but are set to pick up.

Are rate hikes coming soon?

We do not expect any rate hikes from the US Fed or the RBA in the near-term. Instead, we expect both central banks will carefully prepare the market for a rate-hike lift-off, probably sometime in 2023.

In the near-term, financial conditions are still likely to tighten. We expect that will occur as longer- and shorter-dated US Treasury yields drift higher. Higher longer-dated Treasury yields will lift mortgage rates in the US, cooling the economy somewhat.

In Australia, we expect Australian banks to increase standard variable mortgage rates. This could be by up to 100bps over the coming two years. That will ease some of the pressures in the housing market, helping to contain inflationary pressures.

Will housing markets crash?

We continue to expect house prices to benefit from a broader positive environment for asset prices. Tailwinds from economic and wages growth, as well as interest rates that remain low relative to history (albeit higher than right now) will offset the impact of higher rates. In Australia, banks are also likely to tighten lending standards, making it harder to access credit but extending the housing cycle.

Can equities continue to outperform?

We have maintained our overweight view on equities since Q2 2020. Higher inflation and wages pressures will have some impact on profit margins in the US and Australia. But strong economic growth will support earnings. We also expect to see dividend payouts and share buybacks begin to rise, further supporting the market. Higher rates are a risk, but we expect solid fundamentals to offset that impact.

Contact PAS for more information

The Portfolio Advisory Service has been working closely with clients across Australia and Asia to help manage investment solutions and investment governance. Our work is supported by deep asset class research and manager review expertise within the team.

Reach out to our Portfolio Advisory Service to find out how we can assist you with managing your investment challenges.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).