Search posts

Hold your nerve against the spectre of recession

Financial markets tend to be myopic. All too often, the focus is on a single story that is happening now. The fundamental drivers of medium-term returns get lost in the noise. Sensible portfolio construction and asset allocation is about looking through the noise. 2018 has had a noisy start to the year. The hype around trade wars is noise. The on-again-off-again dialogue between the US and North Korea is noise. The short-term market impact from the related ebb and flow of sentiment has obscured the key fundamental outlook. And what is that outlook? How can we use it to build portfolios that will offer through-the-cycle returns? In this month’s CIO Insights – the first in what is to be a monthly publication – I will answer these questions and shed light on our market outlook.

First, the bad news…

The US is heading for recession. And because the US is still the dominant global economy, this means the world is heading for recession.

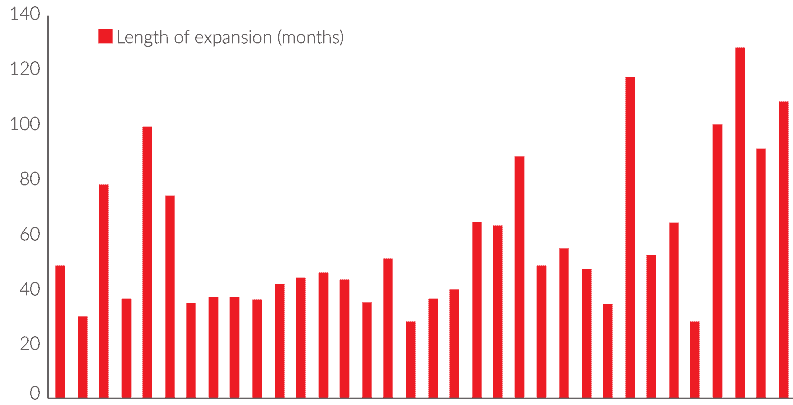

Fig 1: Length of US business cycle expansions through history

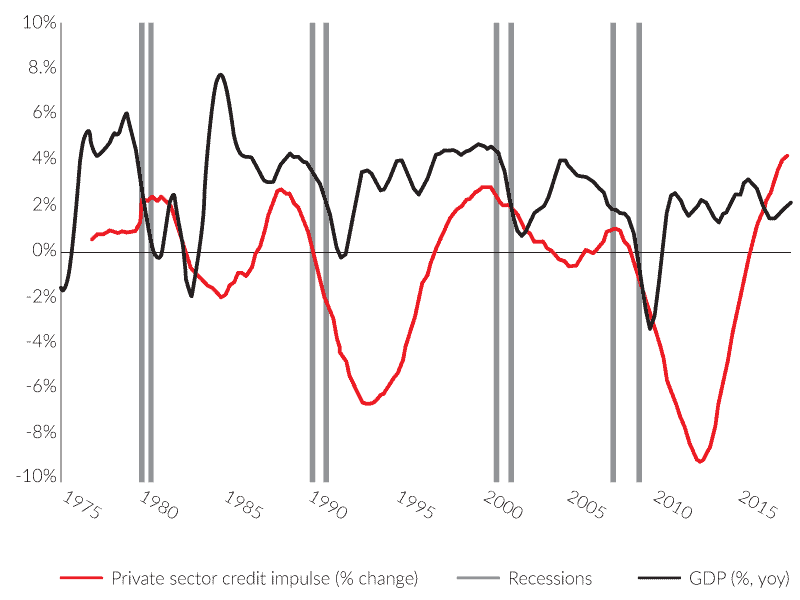

Figure 1 shows that if we were to go 20 months without recession, it will be the longest economic expansion in modern history (since 1854). I think we might reach the end of 2019 without recession, but not the end of 2020. Where are the stresses? I expect this will be an old-fashioned recession. The Fed will tighten interest rates to a level that is uncomfortably high for the leverage in the US economy. Figure 2 shows that the credit impulse for households and corporates – the change in the growth rate of credit – is at its highest level since the 1980s. Fast credit growth has historically led to US recession.

Figure 1 shows that if we were to go 20 months without recession, it will be the longest economic expansion in modern history (since 1854). I think we might reach the end of 2019 without recession, but not the end of 2020. Where are the stresses? I expect this will be an old-fashioned recession. The Fed will tighten interest rates to a level that is uncomfortably high for the leverage in the US economy. Figure 2 shows that the credit impulse for households and corporates – the change in the growth rate of credit – is at its highest level since the 1980s. Fast credit growth has historically led to US recession.

Figure 2: Rapid credit growth has historically led to recession

What is the good news?

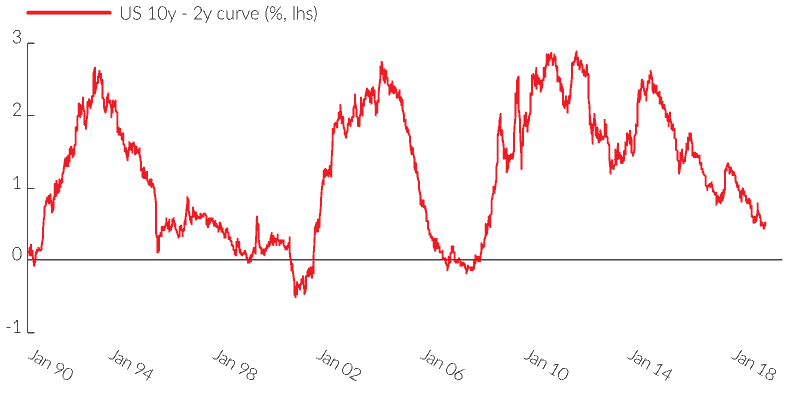

The good news is, we are not in recession yet. Instead we are in the late-cycle with synchronized global growth momentum supporting markets. Late-cycle dynamics – and that is a term you will come to hear a lot in the next 18 months – tend to have typical characteristics. And those characteristics have important implications for investors. Late-cycle dynamics occur when economic growth exceeds potential and erodes economic spare capacity. Inflation begins to move higher. The US Fed begins to hike the Fed Funds rate. Importantly, the yield curve – the difference between the 10-year US Treasury yield and the 2-year US Treasury yield – begins to narrow. The end of the late-cycle has historically coincided with that curve inverting.

Figure 3: The US yield curve is narrowing

How will markets respond?

Developed market equities have historically performed well during late-cycles. Investors opting to sit on the sidelines in cash have suffered significant opportunity cost in terms of foregone returns. Commodities have also performed reasonably, supported by strong growth into the end of cycle. Fixed income, on the other hand, has suffered. Rising Treasury yields have offset the higher yield and has been a significant drag on returns. This is especially the case for longer-duration exposures.

Investors should hold their nerves for now

From a portfolio perspective, it is still too early to disengage from risk in the portfolio. While the yield curve remains positive, dialing back exposure to equities is likely to hurt portfolio returns. On the other hand, exposure to credit markets that are likely to suffer in an environment of rising rates. But what about the spectre of recession looming on the horizon? For now, the best way to prepare is to diversify the portfolio and that means increasing exposure to alternative assets that have low correlation to traditional asset classes such as equities and bonds. Of course – investing in alternatives is not risk free. Like traditional asset classes, alternatives have capital loss risk, and also tend to be less liquid than traditional asset classes.

Summary

While I expect a recession is inevitable within the next three to five years, synchronized global growth seems likely to persist over the next 18-24 months. Over that period, late-cycle dynamics suggest it is still too early to disengage from risk. Moving too early to cash will result in low returns that represent a significant opportunity cost. Instead, sensible portfolio allocations to alternatives that diversify portfolio risk can help prepare for the longer-term risk of recession.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorized copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorized personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorized use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).