Search posts

2022: Focus on the fundamentals

The global economy has moved beyond the pandemic recession of 2020. Monetary and fiscal support and a rapidly developed vaccine provided support to allow the world to enter a durable recovery.

Supply chain disruptions have persisted, and inflation is now higher than it has been in decades in the United States. The recovery is giving way to a more mature phase of the economic cycle. The United States Federal Reserve Bank has indicated that rates will move higher soon. Other central banks are following.

Through all these challenges, equity markets continued to deliver strong returns. Return outcomes diverged across developed and emerging markets. And the shift higher in government bond yields proved a challenge for fixed income markets over the 2021 calendar year.

In 2021 we focused on sustaining the strong portfolio returns we had helped our clients enjoy in 2020. But our medium-term calls can be wrong in the near-term. 2021 was an example of this. Our medium-term call that China would be an important driver of alpha was painful in the context of the massive underperformance in Chinese equities over the year. Similarly in 2019 we wrote that a recession was likely over the coming 24 months. 2019 turned out to be a strong year for growth and for equities.

But a recession did take place in 2020, albeit not for the reason we expected. And the actions we recommended in 2019 and in 2020 – when we reconfirmed our view that a recession was likely – delivered substantial benefits to our clients through 2020 and 2021. We expect that in time – and potentially sooner rather than later – China’s equity performance gap with the rest of the world will close and deliver the alpha we wrote about in 2021.

As we move into 2022 and prepare our fourth Medium-term Global Outlook, our focus is on addressing the challenges attached to a maturing economic cycle. The economy is moving from the recovery phase to mid-cycle. The economic outlook is uncertain. There are many risks. The pathway for global markets depends on how the economic fundamentals play out.

Our upcoming 2022 Medium-term Global Outlook considers four themes, and makes ten recommendations across those themes.

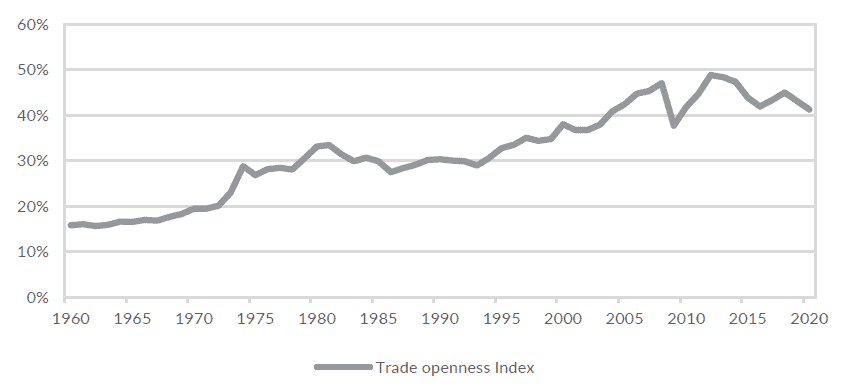

Re-globalization: Globalization – the flow of trade, capital, information and people – has been in decline since the global financial crisis of 2008-2010. The slowdown in world trade has been exacerbated by protectionist policies and nationalist movements. We expect the medium-term will be a period that pauses the trend toward de-globalization. While the nature of trade may change – the “just-in-time” inventory system may never fully recover – we see some upside risk to increased connectedness.

Figure 1: Globalization has been trending lower since 2013, after climbing steadily since 1960.

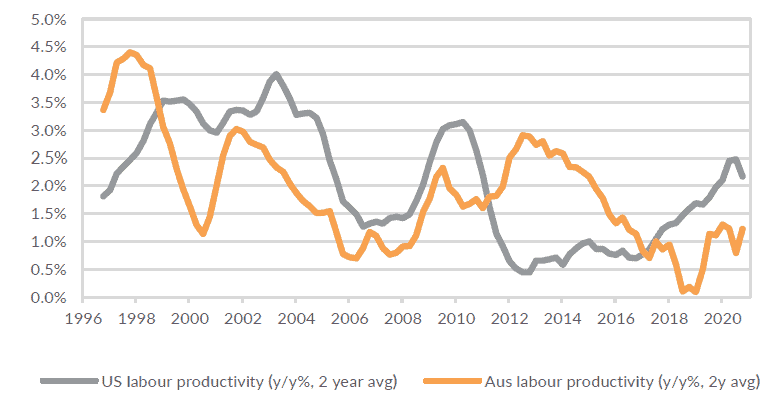

Post-pandemic productivity: In the medium-term, the growth of real income depends largely on productivity growth. Slowing productivity in Australia over the past decade coincided with historically weak nominal and real income growth. This contributed to weak real spending growth. A similar trend can be seen in the US immediately post the global financial crisis. We expect better productivity to help contain inflation in the medium-term. That will allow real wages to increase without adding to above-target inflationary pressures. And that should be supportive of ongoing economic strength over the medium-term.

Figure 2: Productivity trended higher through the pandemic.

Raising capital investment: Capital investment as a percent of GDP declined in Australia and trended sideways in the US over the past 5-7 years. But in 2021, private investment began to improve. We expect that could be the start of a new cycle. A capex cycle may result in money moving out of the safest assets (real US Treasuries) and into the real economy. That will add pressure on real and nominal yields to move higher over the medium-term.

Monetary policy: In 2021, we wrote about the start of a new economic cycle. In the year since, the cycle has progressed rapidly. We expect rate hikes will begin in 2022 and continue through the medium-term. We expect the real 10-year yield to trend back towards zero to slightly positive levels. We expect that will be a sign that a capital investment-led, durable recovery is underway.

Contact PAS for more information

The Portfolio Advisory Service has been working with clients across Australia and Asia to help manage investment solutions. There is a clear move towards managed accounts within the Australian and Hong Kong markets. The Portfolio Advisory Service can help build custom-made managed account solutions or by providing access to our own range of Active Alpha, Active Beta Plus and Active Beta portfolios. Our work is supported by deep asset class research and manager review expertise within the team – delivering great outcomes for our partners. Our 2022 Medium-term Global Outlook will be released in February 2022, with more recommendations for using the fundamental outlook to deliver great returns.

Reach out to our Portfolio Advisory Service to find out how we can assist you with managing your investment challenges.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).